When regulators granted Pentagon Federal Credit Union a so-called open charter in 2019, banking trade groups cried foul and said the move could lead to unchecked growth for the $36.7 billion-asset company.

And those fears are being realized.

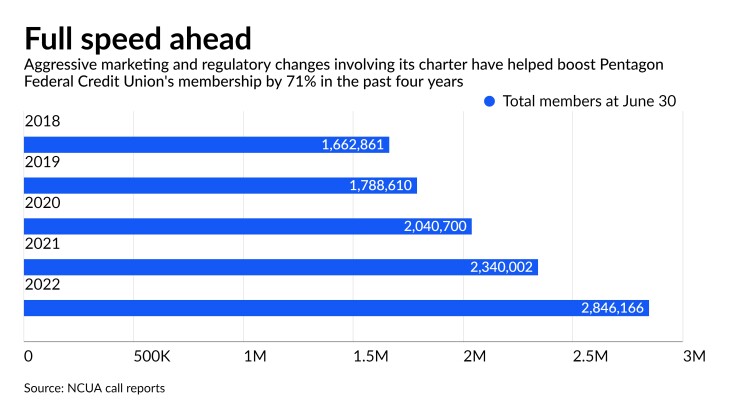

PenFed, the third-largest credit union in the nation by assets, reported record membership expansion in the first half of 2022. The McLean, Virginia, company said it added about 287,000 members — or 11.2% — in the first six months of the year; its total membership now stands at 2.8 million.

By comparison, the credit union industry in total experienced 4.2% annual membership growth in the first quarter, the most recent reporting period available from the National Credit Union Administration.

Much of PenFed's recent growth traces to its

At the time, Rebeca Romero Rainey, president and CEO of the Independent Community Bankers of America, said the deal "negates" field-of-membership limitations on a large, rapidly growing credit union and "runs contrary to the will of Congress."

PenFed President and CEO James Schenck said in an interview that geographic diversity is one of PenFed's strengths. He said many of its members now live in major population centers including the Washington, D.C., area, Texas, Florida and California.

"PenFed's membership growth is a direct result of the digitalization of our member experience, from onboarding to applications to fulfillment," he said. "Over the past several years, we have invested millions of dollars in our digital platforms to make thousands of improvements to best serve our members."

The company has also invested heavily in its workforce and marketing.

PenFed spent $65.3 million on marketing in 2021 according to call report data. The company spent $39.4 million in 2020. By comparison, the $160 billion-asset Navy Federal, the largest credit union in the country, spent $173.8 million on marketing and promotion last year.

The crucial ingredients of PenFed's "winning formula" are strong member benefits including generous deposit rates; a commitment to aggressive spending on marketing; and full use of the advantages of an open charter, says Jim Adkins, managing partner for Artisan Advisors.

"It's interesting to note that PenFed's marketing spend increased during the pandemic while other credit unions went the other way, decreasing marketing expense," Adkins said.

PenFed experienced lackluster growth from 2000 to 2019, in part because of light spending for a credit union of its size, said Luis Dopico, chief economist for the consultancy CU Collaborate. It increased its marketing budget during 2020-21 to twice the level of its peers, he said.

"Marketing expenses per assets are among the most powerful, most proven drivers of growth for credit unions," Dopico said. "It is unsurprising that PenFed's explosion in member growth would coincide with or follow an explosion in marketing expenses."

PenFed's huge membership growth also has coincided with a hiring spurt. Credit union growth often corresponds with campaigns to improve member service, and employees per member are a key component of member service, Dopico said.

PenFed had 3,585 full-time employees at the end of last year, a 31% increase compared with a year earlier. A PenFed spokesperson said the company has been hiring in all divisions.

Schenck said PenFed is proud to have served a growing number of members through the pandemic, during a time when demand for loans was very high. He said as the Federal Reserve's rate hikes raise the price of borrowing, loan demand will decrease and growth is likely to slow for the next few quarters.

PenFed's strategic plan is to have balanced 10% growth in loans and deposits year over year with a 1% return on assets through 2024.

"We have already achieved those goals during the first half of 2022. Due to the rising rate environment, we are planning to strategically slow loan originations and membership growth and focus on building capital, deposits and liquidity into 2023," Schenck said.

He said PenFed will continue to sustain membership growth by offering market-leading rates on certificates of deposit and high-yield savings, appealing credit cards and auto and personal loans.

"Scale matters," Schenck said. "PenFed can spread marketing and technology investments across a larger base of members and potential members. This allows us to continue building the PenFed brand and loyalty year over year."